POOLED FAMILY INVESTMENT STRUCTURES: NAVIGATING THE MAZE

By Gazelle Summe and Matt Herman

May 7th, 2024

More clients are finding that family office structuring is like navigating a maze with ever-changing rules. The Tax Cuts and Jobs Act of 2017, specifically the complexities around the deductibility of investment expenses, has led many wealthy families to reconsider their entity structures and organization of capital pools. When structuring fundamental architecture to hold family assets for long term management, we have seen an evolution in how families benefit from pooled capital by using a few simple structures embedded in a highly customized wealth plan. Determining the appropriate structure, while avoiding unnecessary cost and complexity, requires a family to consider several key elements:

- Centralized decision-making

- Generational investment objectives and risk tolerances

- Wealth transfer and legacy objectives

While there are many factors that influence the final blueprint, such as tax minimization, control and oversight, education, and philanthropic intent, we will explore various structures that can be utilized for managing pools of capital from an investment perspective. Striking the right balance between simplicity and customization can make a significant difference in achieving a family’s objectives.

FAMILY NERVE CENTER

Arguably the most valuable benefit of pooling family capital is providing a mechanism for cohesive family governance. This centralized control mechanism, or what we refer to as the “Family Nerve Center”, is typically established and initially controlled by the senior generation, with clear potential for evolution. Control often extends to distributions, investments, and succession.

There are options as far as choice of legal entity for the nerve center, but a C-Corporation (“C-Corp”) or a Limited Liability Company (“LLC”) are most common. These entities serve as family management companies to consolidate and coordinate services such as investment management, tax preparation, trust and estate, philanthropic strategy, bill pay and administration, etc.

With a small amount of ownership, the nerve center will be connected to most—if not all—family investment entities. This provides a system for streamlined decision-making, continuity in estate planning across multiple generations, and, when structured correctly, a greater after-tax outcome.

We have seen firsthand the benefits of centralization when a multi-generational family adopts a more centralized approach towards investment management, tax, accounting, and concierge services. Take a family with three generational branches, all with their own list of service providers. Each provider operates independently, and the family spends significant time and resources coordinating between them. This fragmentation can lead to communication gaps, inefficiencies, and higher costs due to the lack of a unified strategy. Utilizing a more streamlined approach, the family can reduce the number of third-party connections and ensure a more cohesive and holistic approach to managing their wealth. It can lead to better communication, improved efficiencies, and potentially significant cost savings.

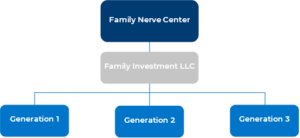

KEEPING IT SIMPLE

Another primary reason families pool capital is to benefit from economies of scale relating to cost, access, and flexibility of investments. Employing one umbrella asset allocation strategy or Investment Policy Statement (“IPS”), governing a single LLC and covering multiple generations, helps to achieve such scale while simplifying the structure and eliminating the need for multiple investment mandates. There are additional planning benefits to this more centralized approach, such as ease of wealth transfer utilizing interests in the LLC. This approach works well for families that prioritize simplicity, have sufficient liquidity, and are willing to agree on a global multi-generational asset allocation framework.

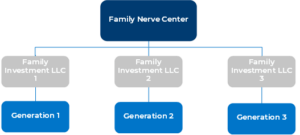

GENERATIONAL INDIVIDUALITY

A significant challenge in successfully structuring family wealth is marrying broader intergenerational wealth transfer goals with generation-specific goals. Accumulated wealth by one generation should be strategically managed and sustained to benefit future generations; however, goals can vary across generations. Generation-specific mandates and Investment Policy Statements empower each generation to pursue distinct financials goals while maintaining cohesion through the overall estate plan. This approach also allows for targeted liquidity management and simplified intra-generational gifting.

From a structural standpoint, this approach entails implementing multiple LLCs by generation, each managed according to their own IPS, and aligned to a generation-specific objective.

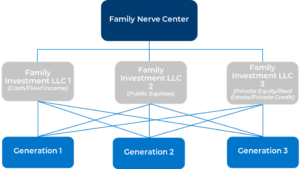

HIGHLY CUSTOMIZED STRATEGY POOLS

A third approach is to pool capital by underlying investment strategies. In this structure, multiple LLCs hold specific asset classes. Rather than manage each LLC according to a diversified asset allocation, the objective or IPS is tailored to the return expectations of each asset class.

This approach provides the highest level of customization since it allows family members to be as precise as they’d like when constructing their generation’s asset allocation. Practically speaking, this structure creates additional complexity as it relates to wealth transfer and ongoing accounting/reporting. Additionally, managing cash flow and liquidity needs in an LLC containing predominantly illiquid investments may also prove difficult if there are significant unfunded commitments and insufficient sources of liquidity. There are ways to address this dynamic through initial funding and/or intra-entity loans along the way.

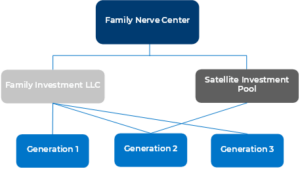

THE UNBOUND FAMILY MEMBER

As family interests, expertise, and engagement evolve over time, there will eventually be family members that are interested in participating in one-off investments that aren’t necessarily suitable for all family members; for example, an emerging entrepreneur who would like to invest in a startup.

A way to address this, would be to pair the primary asset pool with individual carve-outs for one-off type investments. This approach allows family members to modify objectives, risk tolerance, and distribution needs from the primary pool while still following the greater family’s IPS and, ultimately, better allocates the risk and return of these ad hoc satellite investments. It also allows for broader participation across the family in special investments or co-investments they otherwise may not be able to access.

EXPECT THE UNEXPECTED

While the tangible benefits of pooling family capital, such as scale, administrative simplicity, and improved after-tax outcomes, are easily recognized, it’s the intangible advantage that stands out—the fostering of a united family governance system. It’s something we have had the privilege of witnessing firsthand. We’ve seen how consistent decision-making aids families in not just adapting, but thriving, in an ever-changing landscape, all while keeping their long-term objectives within sight. As we approach the expiration of several 2017 Tax Cuts and Jobs Act provisions at the end of 2025, families have a unique opportunity to proactively revisit their objectives in the context of existing planning. It’s essential to recognize that while incremental complexity can accumulate over time, careful planning can lead to enhanced flexibility and a clear path to long-term goals. Better outcomes require not only knowledge, but deep strategic understanding and nuance; all fundamental elements of BBR’s approach to creating lasting peace of mind for families.

Gazelle Summe is a Director of Portfolio & Wealth Advisory. Her responsibilities include working with clients to develop their overall financial strategy, manage their investments, and integrate their investment, tax and estate planning into a cohesive wealth management plan. Prior to joining BBR, Gazelle was a Senior Vice President, Client Advisor at Bessemer Trust working with high-net worth individuals, families and foundations. She is a CERTIFIED FINANCIAL PLANNER™ professional and holds the Certified Trust and Financial Advisor designation.

Matt Herman is a Vice President of Portfolio & Wealth Advisory. His responsibilities include working with clients to develop their overall financial strategy, manage their investments, and integrate their investment, tax and estate planning into a cohesive wealth management plan. Prior to joining BBR, Matt was a partner at Herman & Company CPAs, P.C., and before that, he worked at Epoch Investment Partners on the Portfolio Implementation team. Matt holds a BS in finance from Lehigh University and a master’s in accounting from St. John’s University. Matt is a Certified Public Accountant.

Connect with One of Our Advisors

Important Disclosure Information Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy, including the investments and/or investment strategies recommended or undertaken by BBR Partners, LLC (“BBR”), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from BBR. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Neither BBR’s investment adviser registration status, nor any amount of prior experience or success, should be construed that a certain level of results or satisfaction will be achieved if BBR is engaged, or continues to be engaged, to provide investment advisory services. BBR is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of BBR’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.bbrpartners.com. Please Remember: If you are a BBR client, please contact BBR, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Monthly client reports prepared by BBR remain available on the BBR portal. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.