SMART GIFTING: LEVERAGING NON-PORTFOLIO ASSETS

by Steven R. Katz, JD, LLM, CPA, BBR Partners Dylan T. Stroud, CFP®, BBR Partners Ritesh G. Patel, JD, LLM, Cohen Pollock Merlin Turner

October 28, 2024

In our experience working with high-net-worth families, we often find there is reluctance to having conversations around gift and estate tax planning. By asking the right questions and serving as a collaborative thought partner, we help families discover their optimal solutions. In this article, we will share a few of the effective gifting techniques that have been central to our conversations with clients.

EARLY & OFTEN

Effective gift and estate tax planning should be approached early and revisited regularly. This is especially important as the lifetime gift exemption is set to be reduced on January 1, 2026 to approximately $7 million, about half of what it will be on December 31, 2025. With this potential reduction on the horizon, now is the time to begin or revisit gift and estate tax planning conversations.

ASKING THE RIGHT QUESTIONS

In having gifting conversations, we often express to our client families the importance of living their lives and avoiding structures that negatively impact their lifestyles or create additional stress. We have found this to be of concern with even our wealthiest clients ($1bn+ in family assets).

Once gifting intentions are confirmed, the important question becomes “what to gift?”. For families with diverse assets, we survey the balance sheet to identify the ideal assets to gift. In many cases, it’s preferential to retain cash and daily liquid investments within one’s beneficial ownership to fund lifestyle spending, while making gifts of less-liquid, non-income producing investments with appreciation potential.

CREATIVE GIFTING WITH NON-PORTFOLIO ASSETS

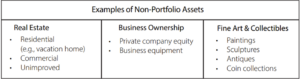

Non-Portfolio Assets, such as real estate, business interests, fine art, collectibles and other hard-to-value assets are often overlooked and can be ideal gifting candidates. They generally do not affect the donor’s personal cash flow needs and the valuation of these assets, for gift tax purposes, may be eligible for discounts that could reduce the federal gift tax value by 20-40% (sometimes even higher) compared with standard valuation methods.

These valuation discounts significantly affect gift tax planning outcomes, particularly for hard-to-value assets. To ensure accurate and accepted discount levels, we recommend enlisting expert third-party appraisers.

Gifting Real Estate Owned Through an LLC

Gifting real estate can be a powerful way to make a discounted gift and may even be further optimized when the property is owned via an LLC. Gifting via an LLC may avoid the complexity of a title transfer.

When considering a gift of real estate, it’s important to think ahead about the overall plans for the property before finalizing the gift. Some key questions are:

– Are there plans to sell the real estate, and is this an indirect way to move cash to a trust?

– Is the real estate indebted?

– Will the new entity have funds to pay ongoing property expenses?

– How will the ultimate beneficiaries be able to manage the property?

These considerations can help ensure a successful and effective gifting process.

Gifting a Family Vacation Home Through a Qualified Personal Residence Trust (QPRT)

Gifting personal real estate to a Qualified Personal Residence Trust (QPRT) is a straightforward approach that generally works best for long term residences or family vacation homes.

For example, let’s say a grantor gifts their $10mm family vacation home to a 10-yr QPRT. In this case, the grantor retains the right to use the vacation home for 10 years and must outlive that period for the QPRT to work. After the term, the property passes into a trust for the grantor’s children or is distributed outright to the children. If the grantor passes away during the 10-yr QPRT term, the home is returned to the grantor’s estate and treated as if the QPRT had never been implemented.

The key benefit of a QPRT is that it allows one to ‘freeze’ the value of the residence for gift tax purposes, so that appreciation on the property after QPRT formation is removed from the taxable estate if the grantor survives the QPRT term. A secondary benefit is that the gift is further decreased by the grantor’s right to use the home for the QPRT term. The IRS provides guidance on how to value this discount and in the case of the $10mm vacation home, there would only be a taxable gift of approximately $4.8mm reportable in the year of the QPRT’s formation (as of 6/30/2024). Importantly, QPRTs function more efficiently in higher interest rate environments, as the higher the discount rate, the lower the taxable gift.

Although efficient from a gift tax perspective, there are administrative complexities that must be considered. For example, if the grantor desires to continue using the residence after the end of a QPRT term, fair market value rent must be paid to the trust for the grantor’s use of the property.

Gifts and Sales of Business Interests

Transferring private business interests can also be an effective way to leverage the value of the gift by utilizing a valuation discount. As with interests in real estate and other assets, completed gifts of business interests may remove such interests (and all future appreciation in such interests) entirely from the donor’s estate.

If there is not enough remaining lifetime gift exemption, or if additional cash flow from the business interests is needed, selling all or a portion of the business interests to a trust in exchange for a promissory note can be considered as an alternative to a gift. If properly structured, the sale of the business interests will have no income tax effect, payments on the promissory note will provide a stream of cash to the donor, and the future appreciation of the business interests will be outside of the donor’s estate.

As with all Non-Portfolio Assets, the transaction must be at arm’s length—that is, a qualified, third-party appraiser should formally appraise the business interest, the terms of the promissory note must be fair and reasonable, and payments required by the promissory note must be made.

Gifting an Art Collection

Fine art and collectibles also offer creative, effective ways to gift. Proper documentation of provenance, maintenance, storage, cost, insurance, and recent valuations are important issues to bear in mind for such assets. As with real estate, owning art and collectibles within a partnership or LLC may help simplify gifting strategies, so that the gifts are of partnership interest versus direct ownership in multiple pieces separately.

Take for example a couple that owns and manages an art collection through an LLC (which has the additional benefit of centralized management). They may gift non-voting shares in the LLC to a trust at a discounted value and remove the art collection, as well as its future appreciation, from their taxable estates. If the couple desires to enjoy the art collection in the future, they could enter into a lease arrangement with the LLC so long as the transaction is at arm’s length. If the LLC wants to purchase additional artwork in the future, the couple may loan monies to the LLC which could offer additional planning opportunities.

GIFT & ESTATE PLANNING AS A JOURNEY

In our experience, engaging in these discussions and devising a versatile gifting strategy can safeguard substantial wealth from gift and estate tax. While the process may seem complex, we often find that these dialogues, filled with reflection and fulfillment, are among the most meaningful interactions we share with families.

Steven R. Katz, JD, LLM, CPA is a Partner, and Director of Portfolio & Wealth Advisory at BBR Partners, working with clients to develop their overall financial strategy, manage their investments, and integrate their investment, tax, and estate planning into a cohesive wealth management plan. Steven holds an LLM in Taxation from New York University School of Law, a JD from Fordham University School of Law, and a BS in Business Management from Cornell University where he serves as an Alumni Ambassador. He is also a Certified Public Accountant in the State of New York.

Dylan T. Stroud, CFP® is a Vice President of Portfolio & Wealth Advisory at BBR Partners. His responsibilities include supporting Portfolio & Wealth Advisory Directors in managing a client’s overall financial picture, including working with clients on day-to-day portfolio management issues and coordinating with external advisors. Prior to BBR, Dylan worked as an Associate at Simon Quick Advisors where he worked with high-net-worth individuals, families, and organizations. Dylan graduated cum laude from Washington and Lee University with a BS in Business Administration and Art History. He also attended the Delbarton School. Dylan is a CERTIFIED FINANCIAL PLANNER™ Professional.

Ritesh G. Patel, JD, LLM practices in the area of estate planning and trusts and foundations at Cohen Pollock Merlin Turner. He helps families and individuals with trust formation, implementing sophisticated estate and gift tax saving techniques, lifetime gifting, charitable planning, incapacity planning, intra-family transactions, and post-mortem trust and probate administration. He regularly provides counsel to multiple generations of families, working alongside their teams of trusted advisors to develop tax efficient and long-term planning strategies to facilitate the family’s ultimate wealth planning goals.

Connect with One of Our Advisors

Important Disclosure Information Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by BBR Partners, LLC (“BBR”)), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from BBR. Neither BBR’s investment adviser registration status, nor any amount of prior experience or success, should be construed that a certain level of results or satisfaction will be achieved if BBR is engaged, or continues to be engaged, to provide investment advisory services. BBR is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of BBR’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.bbrpartners.com. Please Remember: If you are a BBR client, please contact BBR, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian. Please Note: Limitations. The achievement of any professional designation, certification, degree, or license, recognition by publications, media, or other organizations, membership in any professional organization, or any amount of prior experience or success, should not be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results or satisfaction if BBR is engaged, or continues to be engaged, to provide investment advisory services.

CFP® Certification: CFP® professionals have met extensive training and experience requirements and commit to the ethical standards of the Certified Financial Planner Board of Standards (“CFP Board”). CFP® professionals take a holistic, personalized approach to financial planning. As part of the CFP® certification, CFP®s must meet education, exam, and experience requirements. CFP® professionals also have made a commitment to the CFP Board to act as a fiduciary and put their clients’ interests first when providing financial advice to a client.